How's The Market? Data Tells The Real Story

I am very fortunate to be able to state that I am a busy agent and get to speak with homebuyers on a daily basis. My straight forward, no pressure approach of providing core facts and not speculation has served me well and earned referrals from you guys. Thank you for that.

While many media outlets love the click bait of a housing crash, some of the media take a more earnest approach by reporting on the actual facts of the national real estate market. I am often asked the question about our local market here in LA and Pasadena. Will home prices plummet? Is it a bad time to buy? In these discussions I often quote the facts and figures that I regularly stay on top of, and decided to share them with the masses in this article.

For the local buyer. nationwide real estate fluctuations are worthless, statewide California data is also irrelevant. What does matter is hyper-local information as well as the segmentation in which you are buying or selling in. The future of $7 million dollar homes in Bel Air is only relevant to those that own or are looking to buy a $7 million dollar home in Bel Air. The data has to be relevant to the market in which you are in.

Based on the clients I engage in the most frequently, I dive into the data for some specific areas to give you a sense of what the market is really doing. If you want data specific to your situation, just ask, glad to pull it.

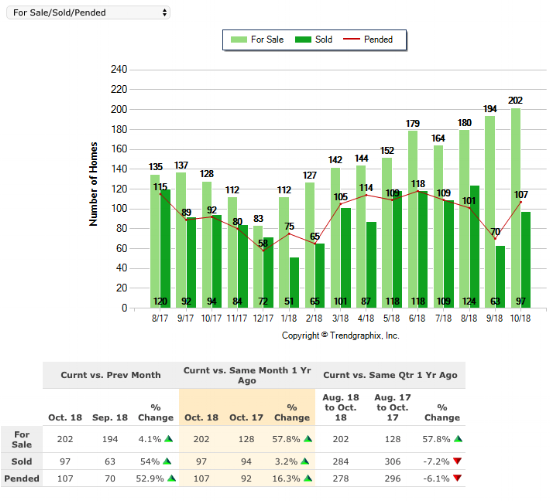

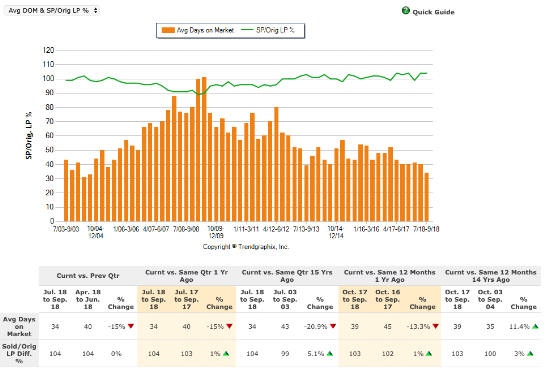

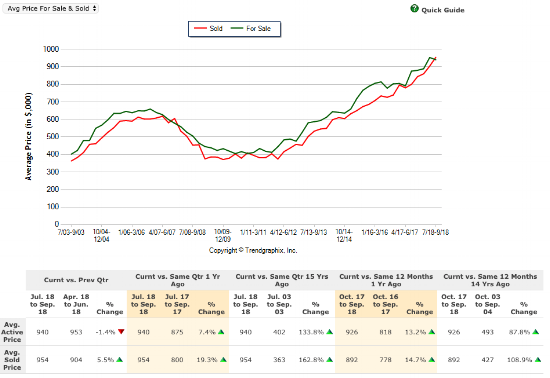

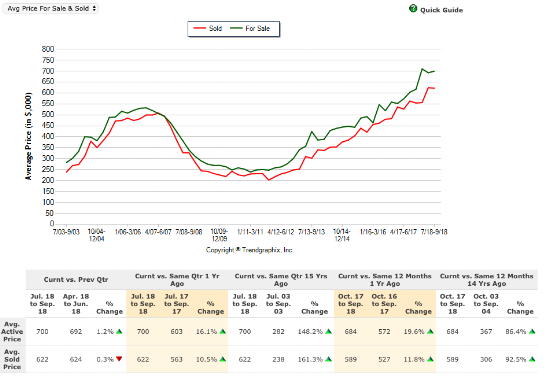

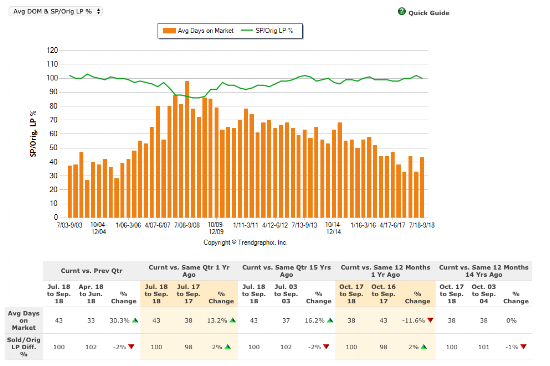

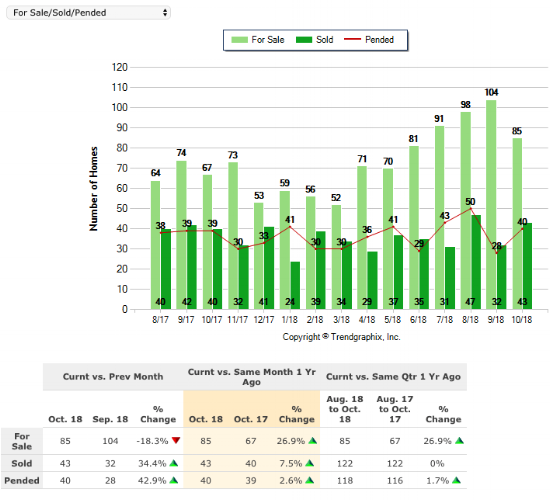

Single Family Home Sales Pasadena & Altadena.

Search parameters. Geographical: All four corners of Pasadena and all of Altadena. Home Type: Single Family Only (not condo, not townhouse or multifamily). Price: $2M and under. Dates: 1 Year of Data and 15 Years of Data.

Analysis:

Inventory is higher than it has been since early 2017 but there are still a LOT less homes on the market. The 200 homes for sale currently in this area is one quarter of the 800 homes for sale during the peak of the crash. Supply and Demand rules. We are still short on inventory. This will not change in the next ten years unless a nuclear war breaks out in Pasadena (highly unlikely).

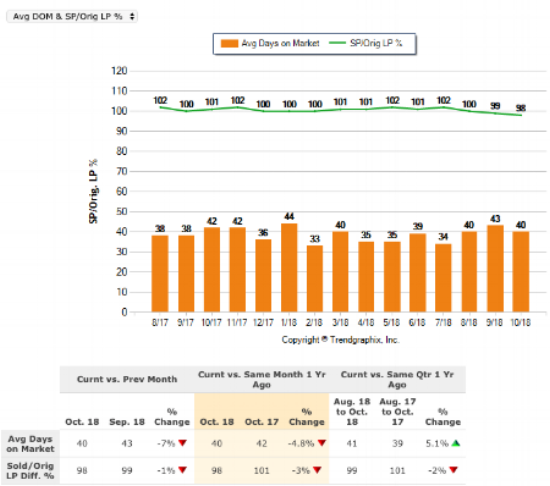

Days on Market. Mostly unchanged since early 2017. There are buyers out there. Not everyone is waiting. Still very low compared to even pre-recession numbers.

Ratio Sales Price vs List Price %: Proof that now is the time to buy. Less competition from other Buyers is causing price reductions and we can see the Sales Price Percentage vs List price percentage drop below 100% to 98%. The market dictates price, even in the height of the recession this number only dropped to 88%. We won’t see that this time. The fear of being outbid is gone. Take advantage of this for a common sense purchase.

Prices: Sales price shows we are 50% up from 15 years ago. That is pre-recession and despite the drop. If we look at the pre-recession peak sold price of $828,000 from May 2007 and adjust it for inflation to 2018 dollars we have a value of $1,009,000. Current average sales price is $992,000 indicating that there will not be some major drop. There may be a blip but it will be minor and it will eventually return to an upward trajectory. The only change is the rapid double digit growth will slow down.

The recession was an anomaly, one that won’t be repeated because the people that have mortgages now actually qualify for them. Pasadena Altadena housing will always be in demand, it will always recover. If you are a flipper, Pasadena may not be for you. If you are looking for an investment for the next ten years, you can not go wrong. If you are hyper focused on increasing value, negotiate a good deal on a property that needs updates and keep to a conservative improvement budget.

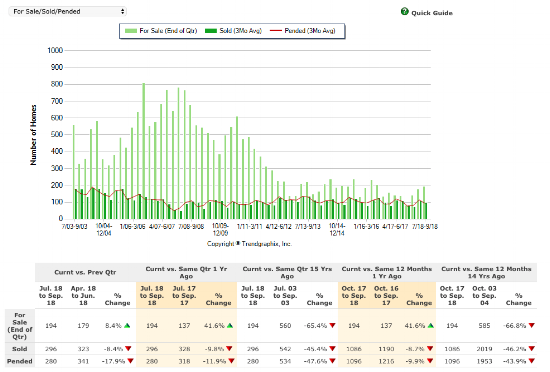

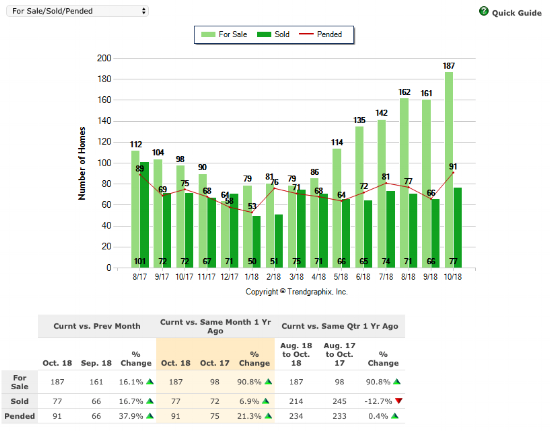

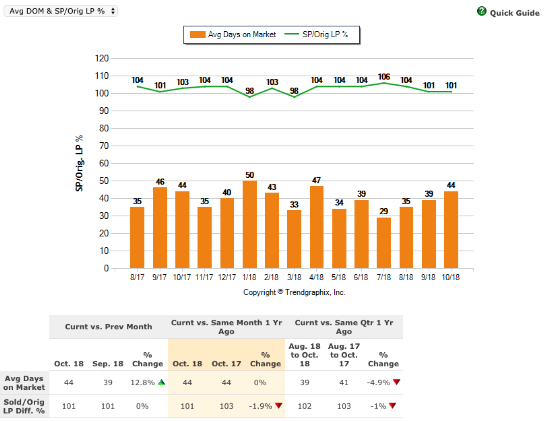

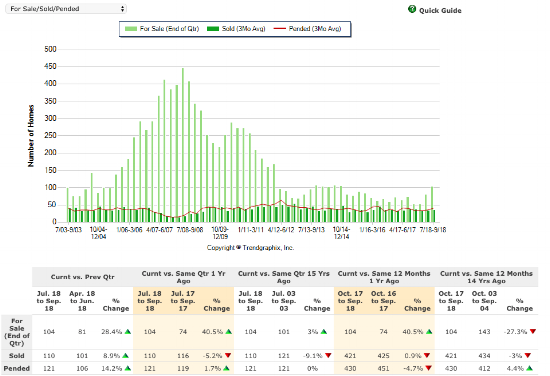

2. Single Family Home Sales- NELA (Eagle Rock, Highland Park, Mt Washington etc)

Search parameters. Geographical: North East Los Angeles: 90065, 90041, 90042 Zip Codes (Eagle Rock, Atwater Village, Highland Park, Mt. Washington, Cypress Park, Glassell Park). Does not include Silverlake/Los Feliz. Home Type: Single Family Only (not condo, not townhouse or multifamily). Price: $2M and under. Dates: 1 Year of Data and 15 Years of Data.

Analysis:

Inventory: Again we see inventory being up this year (more choices for buyers), but we are well below the masses of inventory from during the crash. Low supply will keep values steady. Number of homes dropped in September but not a drop that was out of the norm in the past five years. Volume jumped in October. People are buying, your fear is only making you miss out.

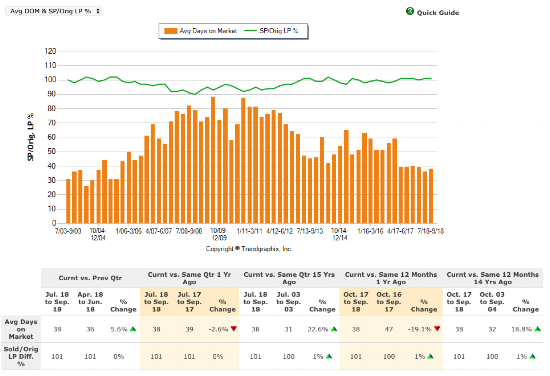

Days on Market: Another prime real estate market indicator, DOM in NELA is still very low. The shift in urban living desires and the proximity to DTLA, makes NELA a hotbed for sales and a place people really want to live in. Urban hipsters moving out of lofts keeps the demand high.

Ratio Sales Price Vs. List Price. NELA’s LP vs SP is almost always 100%. This doesn’t mean every property sells for over list, but more of an indication that price reductions and offers significantly below list are not the norm. The demand is high, the handful of agents that dominate this area know how to get sellers to price intelligently. While a low-ball offer make not take, an investment in NELA is rock solid area to buy property.

Prices: We saw both a drop in average sales prices and average listing prices recently. $618,000 pre-recession sales peak price from May 2007 and adjust for todays dollars we get to $753,000 yet the average sold price is $945,000. Granted the demand for living near DTLA was a lot less in 2007, prices here feel inflated and I would think average prices will drop to just under $900,000. My advice would be to negotiate like crazy unless you are looking for a forever home.

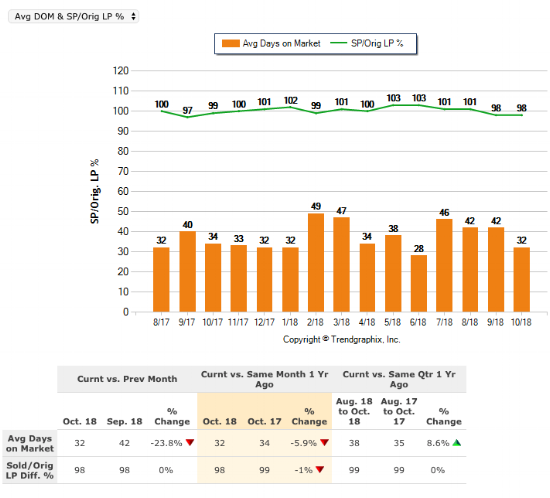

3. South LA -Expo Park, USC, Jefferson Park

Search parameters. Geographical: South Los Angeles: 90062, 90037, 90018 and 90007 Zip Codes (Eagle Rock, Atwater Village, Highland Park, Mt. Washington, Cypress Park, Glassell Park). Does not include Silverlake/Los Feliz. Home Type: Single Family Only (not condo, not townhouse or multifamily). Price: $2M and under. Dates: 1 Year of Data and 15 Years of Data.

Analysis

Inventory: Another area where listing inventory is slightly up, still well within post recession norms and less than 25% of the inventory of what we saw in the crash. The number of homes that sell monthly is up compared to last year as this is ground zero for first time homebuyers that got priced out of NELA. This area is what I predict to be the next hub of gentrification so we could see an uptick in inventory as aging homeowners look to cash out, but it won’t be a flood, this is a traditionally lower-income area and their options for relocation in LA are few and far between.

Days on Market: DOM in South LA is lower than NELA and Pasadena. Houses properly priced (houses that are over priced languish for 60 days or longer in LA). Affordability makes things move fast here, many times remodeled historic Craftsman’s in this neighborhood sell in less than a week.

Ratio Sales Price Vs. List Price. We do see this ratio dropping below 100%. So price reductions and sales below list are happening in more sales than not. This area has been targeted by flippers pretty heavily this year and those flippers are feeling the yield of buyers so we see drops in price and deals happening.

Prices: Sales price averages actually increased here recently while listing prices have come down to meet them. Market correction for sure but no drop in prices. If we correct for inflation we can see pre-recession averages from May 2007 of $508,000 and adjust that to todays dollars we get $619,583. Todays average sale price in this area is $622,000 indicating it is right in line where it should be. Another area where no significant drop will happen.

Overview.

Looking at peak recession prices, adjusting for inflation and then comparing to average price today does indicate areas where prices have grown unnaturally. Does this prove prices will drop? Time will tell, to me it tells me prices are overvalued and the market traditionally always finds a way to iron out these high spots. If you want to know where your neighborhood falls into any of this, just email me, glad to pull data for homeowners and home buyers.

A Warning For The Wait and See Approach

While some areas that are slightly inflated may come down, many areas will not, demand is too high and inventory is low. This is SoCal, not Tulsa, people want to live here. The one thing we do know is that interest rates will go up. This is 100% for sure, and it will most likely hit 5.5%, up from the current 4.75%. On a $950,000 loan amount, that is a monthly difference of $439.00, that is $5,268 more annually and $158,000 more over the life of the loan. There is no way in heck prices are going to drop that much. A house is an investment not a stock you can time. Buy smart, have a good agent help you and you will be glad you have an investment to sink your rent into.

A note on those waiting to buy in the hopes that home values will drop.

MORE ARTICLES

Michael Robleto

REALTOR®-Compass Real Estate

213-595-4720

Michael Robleto is a Pasadena based REALTOR®. His analytical and open approach to sales and representation have served his clients well in his twenty years of sales experience. Michael is a staunch homeowner advocate that blends compassion with a highly advanced technology-driven approach to the buying and selling of real estate in and around Los Angeles. His client accolades of insight, integrity and hard work support the fact that he is not your average agent.

Michael leverages his personal passion for historic architecture to provide his clients the unknown insight on the pros and cons of older homes. Michael, a California native, grew up in an older Bungalow home and has spent 23 years in Southern California admiring the unique architecture of the region. He often writes on homeownership strategy, historic residential architecture and Pasadena related topics which can be found on Facebook, YouTube, Twitter and Instagram under the common profile name of his blog; BungalowAgent or at www.BunaglowAgent.com/blog.

Michael is a committee member and frequent volunteer for the preservation efforts of Pasadena Heritage as well as a supporter of the Five Acres center for children.