Market Watch: Summer Predictions for Buyers & Sellers

Real Estate has been on a wild ride since the pandemic started. The first weeks were a total shut down and since then we have only seen significant market activity (and prices steadily climbing).

Home sellers have been the winners through all of it, although, homebuyers that were able to have an offer accepted can also be seen as winners.

So what will the summer months and the rest of 2021 bring? here is what the data says and what the near future will likely bring.

The Stats

A peek at the sales data over the past fifteen months tells the tale of the market. Being that my specialty is PreWar and MidCentury single-family houses in Silverlake, Los Feliz, Eagle Rock, Highland Park, Altadena, and Pasadena, the following data is based just on that.

Every market segment has nuance and this will most likely apply to all single-family houses in Los Angeles County. For simplicity, I filtered it to properties priced from $800,000 to $2,000,000. Specialty areas like Palm Springs or lofts in Downtown LA will be different. If you want that data, just ask.

Houses for Sale/SOLD

The number of houses for sale in these areas has dropped 55% since the recent peak of homes for sale in June 2019 (224 homes vs 101 homes) and 31% down when comparing May 2021 to May 2020. Supply is seriously down.

While the number of houses for sale has dropped, we saw a spike in sold properties in April 2021 at 151 properties sold vs 87 properties sold in April 2019 representing a 73% increase in sold properties. Showing that demand is through the roof.

The dramatic swings in both supply and demand are causing the spike in home prices in Los Angeles (and across most of the nation).

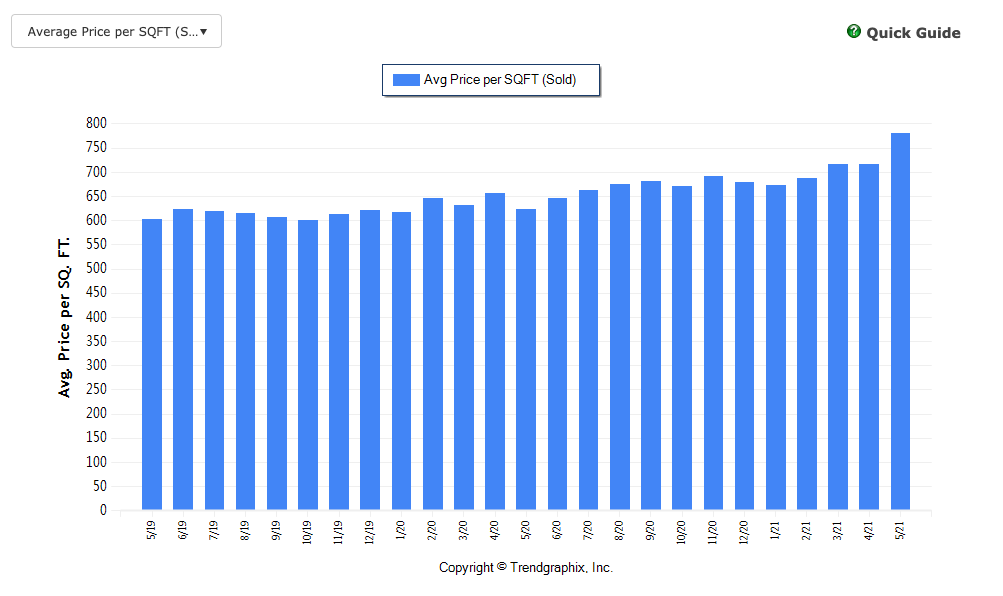

Price Per Square Foot

The increase of home values can be seen in the comparison of average price per square foot (PPSF). In May 2019 the PPSF was $602.00, as of May 2021 it is up to $781.00 (a 30% increase). In May 2020 the PPSF was only 623 so we can see how it has ramped up 25% just in the pandemic.

Days on Market

The time it takes for a home to sell is another indicator of market activity as the number of days a home is available for sale shortens as the market heats up. This number isn’t always reported accurately as some agents use the day an offer is accepted and some use the date the transaction closed (which is usually 20-30 days later). Regardless, the Days on market hit an all-time low in May 2021 with a mere 16 days on average for a property to sell.

SOLD Price vs Listing Price

Proof of the multiple offers that are coming for every home sold can be seen in the ratio between the original listing price and the actual sale price averages (the thin green line in the above chart). As of May 2021, homes are on average selling at 113% of the original listing price. Only multiple offers in the double digits will create a stat like this.

Average Sold Price

The average sales price is a more challenging stat to garner insight from the small set of homes that I have been using (Built pre-1965, under $2M in Los Feliz to Altadena) as one or two premier properties could spike the numbers.

If I remove the price filter from the previous charts and the PreWar and MidCentury build years, we get a better sense of the market and can see the increase in average sold prices (the red line in the above chart). For all single-family homes in the neighborhoods of Silverlake, Los Feliz, Highland Park, Eagle Rock, Altadena, and Pasadena there has been a 23% increase in sold prices.

This is why now is the best time to sell.

As we keep hearing the market is red hot right now. This is why now is the best time to sell but for how long? Let’s continue.

Home Sellers Today and Tomorrow

As we can see, it is a perfect storm for home sellers. Your house will sell undoubtedly. How much it sells for and how fast, is still dependent on how you prepare your home for sale and how it is promoted.

Home values are predicted to continue to increase over the next two years but by significantly smaller increases. (Data firm John Burns predicts a 6% increase in home values in 2022 and 4% in 2023).

The drop in growth will come from an increase in supply as more new construction projects start to take advantage of the increased values. Demand could waiver if interest rates start to creep up which will happen before the end of 2023.

If I was considering selling, now is the time, I would not wait until 2022.

Home Buyers Today and Tomorrow

What we can’t see in the data, is what is happening right now in the month of June (data is always one month behind). My prediction is that we will see a drop in closings in the month of June and July. Here is why:

The first sign is that the mortgage brokers that I speak to have seen a drop in home buying applications (an early indication of a slowing) and several agents I have spoken to have shared a slight sense of buyer fatigue for those that have written multiple offers without securing a home.

I believe the cause of this change is due to pandemic restrictions being lifted. After fifteen months of full and/or partial lockdowns, people want to enjoy life. Summer is here and people want to travel. Hotel bookings are up, airport traffic is back to pre-pandemic levels. It makes sense that some would rather travel than continue to battle the SoCal home buying market.

Buyers that stay in the fight will benefit.

Will this be slowing demand be enough to trigger a price drop? Unfortunately no, it will not be enough but perhaps there will be less competition in getting an offer accepted. Buyers that stay in the fight will benefit.

Another plus for buyers has been the fact that appraisals have now caught up. When buying a home, your mortgage lender will require an appraisal. Those appraisals are based on the sold prices of nearby homes from the past six months.

As prices spiked, appraisals were based on the previously lower prices causing many homes to under appraise. Buyers would have to cover that appraisal gap in cash. Adding a $150k for appraisal gap coverage to a $200k downpayment on a one million dollar home could be a tough pill for many homebuyers to swallow. Thankfully, appraisals have now caught up.

One item of warning is an impending change to interest rates. We have been at record low levels since the pandemic but that is going to change. Today, The Fed announced that there will be two interest rate increases by the end of 2023. Prices will not drop significantly before 2023.

The Smart Buyers Move for 2021

My recommendation to my homebuying clients is to buy a home that needs some remodeling work. Move-in ready homes are driving the bidding wars and are selling at record high prices. Homes that need work (the worse the better) are going to have less buyer competition and less of a price spike. The perfect scenario would be to find one that needs a bunch of work but you can still live in it.

Everyone’s situation is different, but one fact remains, home prices are what they are and there will be no mass flood or foreclosures, or corrections. Buyers that felt prices were too high last year are now faced with prices being 23% higher. Waiting longer to buy will only cost you more.

There are deals out there but you aren’t going to realize them from doom-scrolling on Zillow. If you have been pondering buying, we should have a conversation.

Michael Robleto

Compass

213.595.4720

michael.robleto@compass.com

MORE ARTICLES

Michael Robleto is a Los Angeles based REALTOR® that specializes in Historic, Pre-War and Mid-Century homes in Pasadena, Altadena and east side cities like Los Feliz, Silverlake, Eagle Rock, and Mount Washington. Michael uses his vast knowledge of older homes, residential construction, and modern-day marketing to predict and solve the many problems that arise in real estate transactions. His client accolades of insight, prompt communication, integrity, and hard work support the fact that he is not your average agent.

Michael leverages his personal passion for historic architecture to provide his clients with the unknown insight into the pros and cons of older homes. Michael, the son of a contractor, a California native, grew up in an older Bungalow home and has spent 23 years in Southern California admiring the unique architecture of the region. Michael brings 20+ years of negotiation and sales experience to his seven-year career in residential real estate. He often writes on homeownership strategy, historic residential architecture, and related topics that can be found on Facebook, YouTube, Twitter, and Instagram under the common profile name of his blog; BungalowAgent.

Michael sits on the Board of Directors of Pasadena Heritage and is frequent volunteer for the preservation efforts of numerous historic neighborhood associations and the LA Conservancy. When not working you can find Michael on hiking trails statewide with his faithful German Shepherd Axel.